PARTNER COMPENSATION STRUCTURE – THERE IS NO PERFECT FORMULA

In every society, there is a “bond” or “links” among its members that may have several features, but the main one is the individual conscience that being together is better than being alone.

In law firms, this glue is mainly represented by a technical complementarity, that is, lawyers from different specialties that get together in order to render a more complete service to their clients. Besides it, for the society to prosper, other characteristics are also necessary in order to feed its growth, such as: entrepreneurial vision, technical knowledge, relationships and capturing capacity and skill in managing clients and staff.

All those attributes, when “gathered and mixed” (referral to a fashion expression)) make up the relativisation matrix among partners, but the way it is structured and the importance given to each attribute varies from one office to another and the result of its use in the partners’ compensation model may become the weak link of the chain that gathers them.

The first aspect we should understand is that this matrix of attributes may not be correctly applicable, mainly due to the lack of reliable data and/or information for the correct marking out among their participants. This constraint may be higher or lower, depending on the degree of the maturity of the controls in which the society is in each of its growth phase. One expects that in the initial months or years, the organization has no sufficient financial good standing to invest in administrative managerial structure and systems able to produce the necessary reports.

Another very important aspect to be taken into account is the so-called entrepreneurial philosophy adopted by the company which, in the law offices, tends to be the mirroring of the individual characteristics of their founding partners. Example: an office that is incorporated by an attorney with a predominantly profile for client attraction will have in its initial times the tendency to value this attribute of its stakeholders and partners.

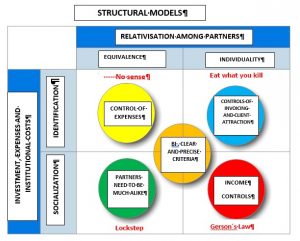

Regardless of the previously analyzed aspects, we can practically place in a bi-dimensional matrix those two perspectives of how the partners see the philosophically correct forms for self – relativisation and control of the investment, costs and expenses of their organization.

In the first item, this relativisation may vary from a more subjective “approach” of equivalence among the partners, imagining that each individual has his more or less developed capabilities for each one of the five characteristics that make up the “glue” among the partners (referred to above) and which compensate themselves making them equivalent and (lockstep), up to the extreme end where what is of interest is what one can attract, produce and invoice (eat-what-you-kill).

In the second item, we can vary from the complete socialization of all investments, costs and expenses, where all that is under the institution liability, regardless of its originator, need, sector or partner, up to the other end where all expenses are individualized and computed as being under the generator’s liability.

In the lower left quadrant we have the equivalence among partners, that is, there is a compensation among the five attributes that make up the “glue”, the partners must be technically alike and the expenses (investments, costs and expenses) are socialized in the institution. In this quadrant the “lockstep” form of relativisation can be perfectly fit, but it is only kept if there is no big variation among the individual dedication and commitment by each partner along the time.

In the upper right quadrant one finds the concept that is diametrically opposed to the previous one, where each partner is valued due to his individual characteristics and according to the importance given to the attributes in the company and normally to those that represent “cash on hand”. In the scope of the expenses, there is also the identification and its total individualization by the partners or the sector to which he is responsible for. In that model, each sector operates as a totally independent cell, as if it were an office within an office. In this quadrant, one can identify the offices of the so-called “eat-what-you-kill” philosophy.

In the lower right position we have what I refer to as the “Gerson’s Law” quadrant and for those who are young and do not know anything about it, I briefly explain: The soccer player of the three- time world champion team of 1970 starred in one advertisement for cigarettes where he said “I like to take advantage of all, right?” and unfortunately (to him) this ended up generating, along the time, the negative image of the smart person!

In our case this is the image one wants to convey, as in this quadrant the revenues are computed in the individuality generating higher importance to its generator and the expenses are socialized among all. This is not a formula that will work out right along the time!

In the upper left position one finds the quadrant with the equivalence among the partners and the individualization of the expenses, which it the denial to the own philosophy of equivalence and, as far as I am concerned, there is no office in this situation (but it is there for didactic purposes only).

I am not going to define as right or wrong the perspectives described and simplified in the picture above, because I am quite sure that every firm defines their own and that blends with the characteristics of the managing partners, but anyway I will express my humble opinion: I consider the intermediate situation existing between the lower left quadrant and the upper right, providing they have well defined attributes as well as correct and trustable reports, the more rational situation and the one that have a better chance of survival along the time!

José Paulo Graciotti, is consultant and founding Partner of GRACIOTTI ASSESSORIA EMPRESARIAL, engeneer by Escola Politécnica Universidade de São Paulo, with Financial MBA at FGV and specialized in Knowledge Mnagement by FGV. ILTA Member since 1998 (International Legal Technology Association) and ALA (Association of Legal Administrators), with more than 27 years managing Law Firms in Brazil – www.graciotti.com.br